Julie Mehretu, Kehinde Wiley to Design American Express Platinum Cards

Table Of Content

But these credits may not align with where you’re spending your money. And if you’re seeking plush travel perks, the card doesn’t come with any. Consider that there’s a $695 annual fee, which means that no matter how fancy those statement credits are, what you’re essentially getting with the card is an upscale coupon book. Pay the annual fee and get discounts that will potentially outweigh the cost of ownership, but only if fully maximized.

Up to $100 to Cover the Application Fee for Global Entry or TSA PreCheck

Additionally, if you don’t have excellent credit and a good income level, you may not be approved for this card. Finally, if you prefer cash-back cards or have no need for exclusive lounge access or discounts on airfare, then this card may not be right for you. When you choose to apply (and are approved) for a new credit card through our site, we may receive compensation from our partners, and this may impact how or where these products appear.

How much are 150,000 Membership Rewards Points worth?

Check out Upgraded Points contributor Lori Zaino’s look at whether or not she will keep or cancel the Amex Platinum card. To do this, I keep a detailed spreadsheet of the value I get out of each high annual fee card I have to ensure it makes sense to keep them long-term. Over the years, the value I calculated for the Amex Platinum card has been pretty close to the annual fee cost, making it hard to decide whether or not to keep it.

Automatic credits

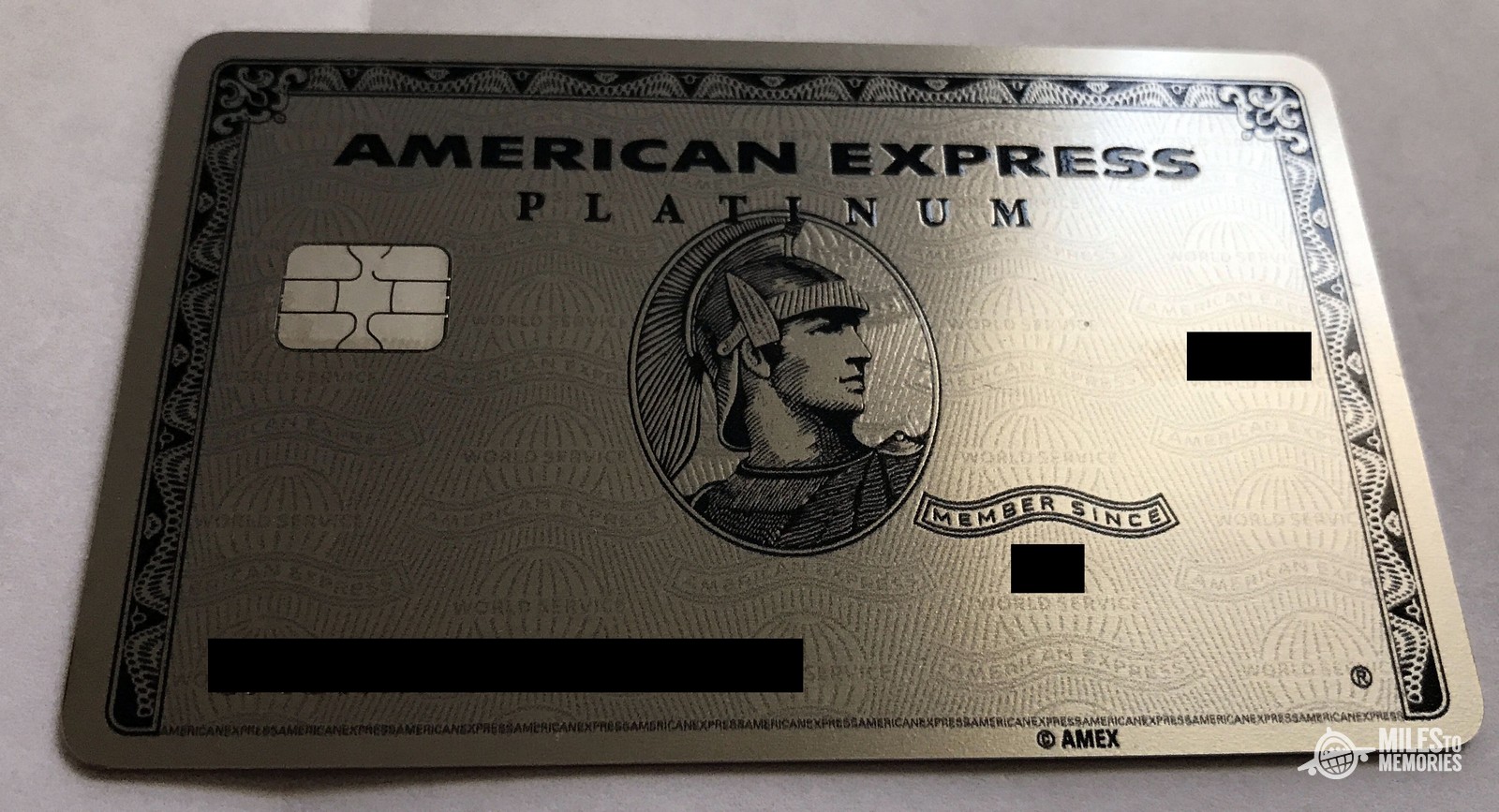

But for a long time, The Platinum Card from American Express was the only premium rewards card on the market. With its sleek design and hefty metal weight, there was a bit of prestige attached to being an Amex Platinum cardholder. If you’re interested in this card, check to see if this is your highest offer.

She was the recently the subject of a major mid-career survey that showed at the Los Angeles County Museum of Art in 2019 and the Whitney Museum in New York in 2021. In 2004, with a group of fellow artists, she cofounded a residency program, Denniston Hill, in the Catskills. During a conversation between artists Julie Mehretu and Kehinde Wiley hosted by the Studio Museum in Harlem on Wednesday night, American Express announced that it had tapped the two artists to create designs for its U.S. The designs by Mehretu and Wiley will be unveiled next month during Art Basel Miami Beach and will be available to American Express Platinum Card holders beginning in January. Keep tabs on your account activity with fraud, payment, and purchase notifications.

Amex Platinum vs. Business Platinum: Which premium Amex card is right for you? - The Points Guy

Amex Platinum vs. Business Platinum: Which premium Amex card is right for you?.

Posted: Fri, 26 Apr 2024 07:00:00 GMT [source]

New cardmembers can take advantage of an 80,000 Membership Rewards Points after spending $8,000 on purchases in the first six months of card membership. Our team of experts evaluates hundreds of credit cards and analyzes thousands of data points to help you find the best card for your situation. Receive a $100 statement credit if your qualifying Schwab holdings are equal to or greater than $250,000 or receive a $200 credit if your holdings are equal to or greater than $1,000,000 following card account approval and annually thereafter. This card is the most rewarding for travel, with 5x on flights booked directly with the airline or through Amex Travel (on up to $500,000 on these purchases each calendar year) and 5x on hotels booked through Amex Travel. The Amex Platinum's $695 annual fee is steep, but the various annual credits can recoup the entire cost (and more), even before considering the card's other perks. Each Membership Rewards point is worth 2 cents, thanks largely to the program's airline and hotel transfer partners.

American Express Platinum Review (80k Bonus Offer!)

Treat yourself and discover new shows, news and recipes with Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Get up to $20 in statement credits each month when you make eligible purchases directly from one or more of our participating partners with your Platinum Card®. Plus, Platinum Card Members will get exclusive access to special perks from time to time. But while sticker shock is real, there is more to a card than its annual fee.

Amex Platinum card review: High annual fee with loads of perks

You become eligible for expedited security, provided you add your Known Traveler ID number to all your pertinent frequent flyer accounts. In case you aren’t presently registered with either of these, Global Entry is the one you must definitely look into. Purchase Protection is an embedded benefit of your Card Membership and requires no enrollment. It can help protect Covered Purchases made on your Eligible Card when they’re accidentally damaged, stolen, or lost, for up to 90 days from the Covered Purchase date. Please read important exclusions and restrictions to see if your item is eligible for coverage.

If you add an authorized user who applies for Global Entry in the first year, that's $100 worth of benefits right off the bat, which covers more than half of the $195 additional annual fee. Of all the benefits we receive by being Amex Platinum Card holders, this one is probably my favorite. But because we use our Amex to cover the monthly $12.95 cost of Walmart+ (terms apply, enrollment required), I rarely have to stroll through the store.

1Take your workout to the next level with on-demand classes and more from Equinox+ digital fitness app. Get up to $300 back each year when you pay for an Equinox+ membership with your enrolled Card. With Hilton Honors Gold status, you can enjoy benefits at hotels and resorts within the Hilton Portfolio and earn reward stays faster with Hilton Honors Bonus Points.

Many people think that the Chase Sapphire Reserve or Sapphire Preferred are the best cards for transferring miles to airline and hotel partners, but, this is also possible with the Amex Platinum card. Get up to $100 in statement credits annually for purchases at Saks Fifth Avenue or saks.com on your Platinum Card. Yes, access to airport lounges is one of the best benefits of having an Amex Platinum card. As a cardholder, you’ll get access to Centurion Lounges, Escape Lounges, Priority Pass lounges, Delta Sky Clubs (when flying Delta), Plaza Premium Lounges, select Lufthansa Lounges (when flying Lufthansa), and select Virgin Clubhouses. This may be the easiest credit to use of the bunch and one that may be valued closest to face value. You just need to make your prepaid hotel reservation through Fine Hotels + Resorts or The Hotel Collection via Amex Travel and get $200 back in statement credits annually.

You’ll get even more value if you use the credits for Indeed and Adobe (worth $360 and $150 annually). Also, the value of benefits like lounge access and travel protections can be worth their weight depending on your travel needs. There’s an exciting perk that can add value to this card for many people. There’s also a digital entertainment credit, making this card one of the best for streaming services. Cardholders can get up to $20 in statement credits each month when they pay for eligible purchases with the Platinum Card®. Get free access to over 1,000 airport lounges that belong to The Centurion Lounge, International American Express, Delta Sky Club, or Priority Pass Select (enrollment required) lounge networks.

Unfortunately, the card carries a 2.7% foreign transaction fee (see rates and fees). The Platinum card does not impose this fee (see rates and fees), making the Amex Blue Business and Platinum cards an excellent card pairing. Pairing the Amex Platinum with another card offers numerous advantages.

Points are worth 1 cent each when used this way for flights but only 0.7 cents each when you redeem for prepaid hotels, rental cars and cruises. Our editors are committed to bringing you unbiased ratings and information. We use data-driven methodologies to evaluate financial products and companies, so all are measured equally. You can read more about our editorial guidelines and the credit card methodology for the ratings below. For many, the usability of the card's many annual credits may make it or break it. If you can maximize the credits, they can more than make up for the card's steep annual fee.

I use low valuations in my calculations to ensure that I am looking at a card’s value realistically. While I enjoy all of those things, those aren’t the reason I keep the Amex Platinum card in my wallet. Trip Delay Insurance, Trip Cancellation and Interruption Insurance, and Cell Phone Protection Underwritten by New Hampshire Insurance Company, an AIG Company.

The American Express® Gold Card and The Platinum Card® by American Express offer distinct benefits that complement each other. When paired together, these two cards can help you earn more rewards and achieve your travel goals faster. Each card offers its own strengths, providing rewards and protections, both while you’re traveling and staying home. While their annual fees are higher than average, their numerous statement credits can help offset these costs. Even among premium cards, the Amex Platinum Card stands out for offering the longest list of benefits you'll find. This includes both a healthy selection of travel credits and perks like lounge access, as well as statement credits for Saks purchases and access to the Amex concierge service.

Comments

Post a Comment